Brand new property atic collapse due to reckless loan providers which ripped off customers on signing subprime funds and in some cases reckless residents which grabbed away funds it understood they might maybe not afford. To deal with that it drama, President Obama along with his Management took a broad number of measures to help you stabilize the newest property erican property owners. These reforms keep Wall structure Path responsible and make certain you to definitely obligation is rewarded and everyone, off Wall structure Roadway in order to fundamental highway, performs by the exact same regulations.

Assist to possess home owners

Four years in the past, be concerned regarding the financial system had honestly reduced the supply of mortgage borrowing from the bank, restricting the ability of People in america to get belongings or refinance mortgages. Nevertheless they located on their own struggling to re-finance at the straight down home loan prices. That is why, because the Chairman Obama’s basic months inside work environment, his Government has taken the second tips to bolster the brand new construction sector which help responsible property owners influenced by this new recession win back the latest stability and you may protection they’d within homes:

- Permitting families refinance their financial to keep several thousand dollars for every single year: The fresh new National government makes it easier for borrowers who are latest on the federally recognized mortgage loans-also people that are obligated to pay over their houses are worth-to take advantageous asset of refinancing at the the current typically low interest. Over dos billion household has actually refinanced from the Domestic Sensible Refinance Program (HARP) and more than step 1.1 million family keeps refinanced owing to FHA’s sleek refinancing program. As well, new Chairman questioned Congress to take and pass common refinancing guidelines in order that people resident that is latest on their costs is re-finance during the the present reasonable pricing and you can save your self regarding $step three,000 annually.

- Permitting more than six mil group remain in their houses using altered mortgages: Brand new And come up with Domestic Affordable System try a critical area of the Obama Administration’s greater strategy to help home owners avoid property foreclosure, stabilize the country’s housing marketplace, and you may increase the state’s economy. Homeowners can also be all the way down its month-to-month home loan repayments and get on so much more steady financing in the today’s lower pricing. And those people to possess just who homeownership has stopped being affordable otherwise common, the application provide a means aside you to avoids foreclosures.

- Expanding usage of prominent protection to possess qualified consumers: The Government lengthened prominent protection through the national mortgage payment and you may tripled incentives to have lenders to minimize dominant balance getting mortgages..It offers with each other aided everything 350,000 parents and you will lead to step 1.7 million coming above-water on the mortgage loans for the 2012..

- Taking out-of-performs Americans the chance of delaying mortgage payments to possess a year while they go back on their feet: Lenders have to offer the new forbearance period to own underemployed home owners with FHA finance regarding four so you’re able to twelve months. Earlier required episodes was indeed ineffective for some unemployed individuals, and you may offering the option for annually out of forbearance provides troubled residents a significantly higher danger of shopping for a job just before they beat their home. Many private business lenders enjoys just like the implemented the Administration’s direct because of the extending its jobless forbearance several months so you’re able to twelve months also.

- Supporting county and local houses financing companies: The Obama administration introduced good $23.5 million Homes Money Agencies Initiative which is enabling more than 90 condition and you can local casing financing firms all over 44 claims give sustainable homeownership and you will leasing tips to have Western parents.

- Giving support to the Very first time Homebuyer Tax Borrowing: The very first time Homebuyer Taxation Credit aided more dos http://www.paydayloanalabama.com/woodstock/.5 mil Western group buy its very first property.

- Broadening the neighborhood Stabilization System: Such finance assist teams buy and redevelop foreclosed and you will given up land and attributes placing Us citizens back to really works, performing less expensive leasing houses, and you can helping the communities that need it extremely. Simultaneously, brand new Chairman brought Investment Reconstruct, which can only help the non-public sector to place construction workers back on the job stimulating vacant residential property and you may businesses.

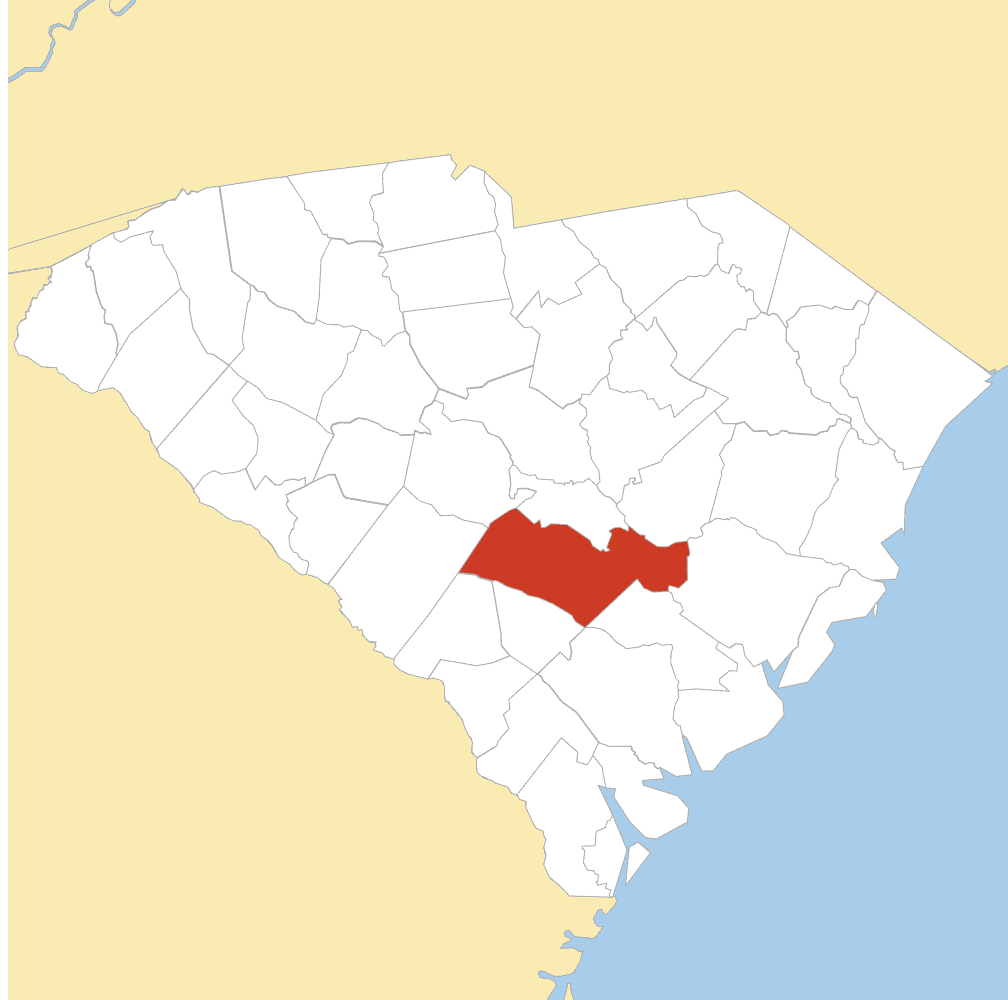

- Carrying out the brand new $7.6 million HFA Toughest Hit Loans: So it funds is support in on the country’s most difficult struck construction segments.

Stopping a different sort of drama

Quite as important as permitting in charge home owners try ensuring that this kind of freeze will not occurs again. The new Government overcame resistance away from Congressional Republicans and put a finish on the unfair credit practices you to caused which crisis because of the: