Once the amount and rate of debt financing are determined, then the model is updated and final terms of the deal are put into place. A leveraged buyout (LBO) is when one company attempts to buy another company, borrowing a large amount of money to finance the acquisition. The acquiring company issues bonds against the combined assets of the two companies, meaning that the assets of the acquired company can actually be used as collateral against it. Although often viewed as a predatory or hostile action, large-scale LBOs experienced a resurgence in the early 2020s. Caesars, which changed its name from Harrah’s, filed for chapter 11 bankruptcy, but before this downfall, they had a significant leveraged buyout transaction for the ages.

In a management buyout, the business’s current management team buys out the current owner. Business owners often prefer MBOs if they are retiring or if a majority shareholder wants to leave the company. They’re also useful for large enterprises that want to sell divisions that are underperforming or that aren’t essential to their strategy.

What Type of Companies Are Attractive for LBOs?

Whether your business is at peak performance and you want to capitalize or your business is reaching the fifth stage of the life cycle and you’re thinking about retirement, an LBO could be a good option for you. For the interest payments we can use the forward Libor Curve from Bloomberg as a starting point. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

The main advantage of a leveraged buyout is that the acquiring company can purchase a much larger company, leveraging a relatively small portion of its own assets. The value of this strategy is that it makes every dollar invested into buying a business stretch farther. In 1985, Macy’s executives organized a leveraged buyout that at the time was the largest in the history of retail. Financial analysts thought it would benefit the company – but instead, it piled on debt that the company couldn’t pay off.

Management buy-in (MBI)

Often, instead of declaring insolvency, the company negotiates a debt restructuring with its lenders. The financial restructuring might entail that the equity owners inject some more money in the company and the lenders waive parts of their claims. In other situations, the lenders inject new money and assume the equity of the company, with the present equity owners losing their shares and investment.

LBO analysis is used to check whether the deal is interesting for a financial sponsor. The ultimate goal of the model is to determine what the internal rate of return is for the sponsor (the private equity firm buying the business). Due to the high degree of leverage used in the transaction, the IRR to equity investors will be much higher than the return to debt investors. While leverage increases equity returns, the drawback lbo stands for is that it also increases risk. By strapping multiple tranches of debt onto an operating company the PE firm is significantly increasing the risk of the transaction (which is why LBOs typically pick stable companies). If cash flow is tight and the economy of the company experiences a downturn they may not be able to service the debt and will have to restructure, most likely wiping out all returns to the equity sponsor.

LBO Model

LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – public-to-private). Think of a Management Buyout as a way for employees to take control of the company in some form or fashion. They do this through purchasing the assets and operations, human capital, IP, etc. that they are already used to administering and operating for profit. This often allows new owners to streamline their cash flows and continue generating profits.

The seller is able to get the price they want for the business and has a way to exit the company with a solid plan in place. A leveraged buyout is an ideal exit strategy for business owners looking to cash out at the end of their careers. A leveraged buyout (LBO) is the acquisition of a company, division, business, or collection of assets (“target”) using debt to finance a large portion of the purchase price. The remaining portion is financed with an equity contribution by a financial sponsor (private equity party). The common type of transaction the private equity firm specializes in are leveraged buyouts.

Meaning of LBO in English

After the buyout of Harrah’s at a 30%+ premium to the market price on the day of the sale, the company had to navigate the housing market crash along with the lack of tourism in the company’s key target markets. Management buy-ins do not come with the stability that management buyouts are known for. However, MBIs do provide an exit strategy for owners who want to retire or who are in over their heads – and for the buyer, they can be a good investment opportunity when handled correctly. But if you’re like many business owners, shutting the doors for good isn’t what you had in mind when you started your company. As Tony says, “business is for gladiators.” You put in the hard work, and you deserve a reward.

A secondary buyout is a form of leveraged buyout where both the buyer and the seller are private-equity firms or financial sponsors (i.e., a leveraged buyout of a company that was acquired through a leveraged buyout). A secondary buyout will often provide a clean break for the selling private-equity firms and its limited partner investors. Historically, given that secondary buyouts were perceived as distressed sales by both seller and buyer, limited partner investors considered them unattractive and largely avoided them.

- In a traditional LBO, debt has typically comprised 60% to 70% of the financing structure, with equity comprising the remaining 30% to 40%.

- July and August saw a notable slowdown in issuance levels in the high yield and leveraged loan markets with only few issuers accessing the market.

- For the management team, the negotiation of the deal with the financial sponsor (i.e., who gets how many shares of the company) is a key value creation lever.

- Other business owners use an LBO as a way to exit the company completely to pursue one where they have more passion as well as profitability.

- Aside from risk, there are several criticisms of leveraged buyouts that are worth considering.

Aside from risk, there are several criticisms of leveraged buyouts that are worth considering. Because the company will often focus on cutting costs post-buyout in order to pay back the debt more quickly, LBOs sometimes result in downsizing and layoffs. They can also mean that the company does not make investments in things like equipment and real estate, leading to decreased competitiveness in the long term.

They’ll want to see ways to reduce costs quickly, selling off non-core assets or finding synergies. Your company doesn’t have to be operating at maximum performance in order to be a good candidate for a leveraged buyout. Companies that may be struggling due to a recession in their industry or poor management but still have positive cash flow are also good LBO candidates.

Capital Structure in an LBO Model

The buyers enjoy a greater financial incentive when the business succeeds than they would have if they remained employees. A leveraged buyout, also called an LBO, is a financial transaction in which a company is purchased with a combination of equity and debt so the company’s cash flow is the collateral used to secure and repay the borrowed money. The IRR rate may sometimes be as low as 20% for larger deals or when the economy is unfavorable. After the acquisition, the debt/equity ratio is usually greater than 1-2x since the debt constitutes 50-90% of the purchase price. Some LBOs before 2000 have resulted in corporate bankruptcy, such as Robert Campeau’s 1988 buyout of Federated Department Stores and the 1986 buyout of the Revco drug stores. Many LBOs of the boom period 2005–2007 were also financed with too high a debt burden.

KKR Pulls Satellite Drifter From Market Black Hole – Bloomberg

KKR Pulls Satellite Drifter From Market Black Hole.

Posted: Mon, 07 Aug 2023 14:10:23 GMT [source]

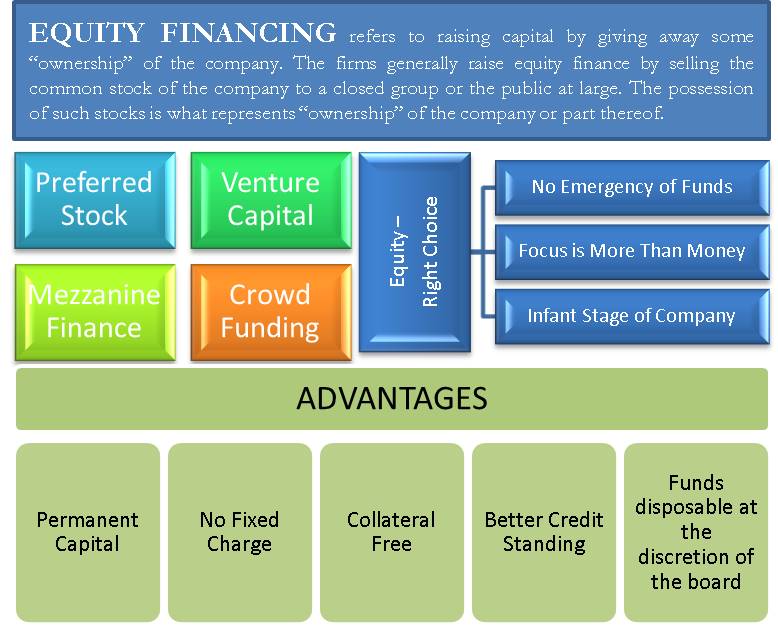

When the company is returned to the market as an initial public offering (IPO), it can be done so with fanfare, renewing the public’s interest in the company. Mezzanine debt is a small middle layer in the LBO capital structure that is a hybrid of debt and equity and is junior or subordinate to other debt financing options. It is often financed by hedge funds and private equity investors and comes with a higher interest rate than bank debt and high-yield debt. Bank debt is also referred to as senior debt, and it is the cheapest financing instrument used to acquire a target company in a leveraged buyout, accounting for 50%-80% of an LBO’s capital structure. It has a lower interest rate than other financing instruments, making it the most preferred by investors.

At times, they will share equity ownership with other financiers, and at times they will also be the ones to contribute debt financing to complete an LBO transaction. Equity firms typically target mature companies in established industries for leveraged buyouts rather than fledgling or more speculative industries. The best candidates for LBOs typically have strong, dependable operating cash flows, well-established product lines, strong management teams, and viable exit strategies so that the acquirer can realize gains.

If so, you’ve probably considered multiple options, from initial public offerings to liquidation. When we have added the sources and uses we need to connect them to the balance sheet. This simply means that a buyer pays more than the book value of the “net identifiable assets”.